When you manage shipping to Dubai from USA, knowing the import international freight rules is the most important step. The UAE has strict laws for any goods entering the country. If you do not follow these rules, your goods will get stuck at the border. You might also have to pay fines or lose your items completely.

In this guide, we share a complete checklist to help your shipments pass through customs easily. If you prepare the right papers and follow the steps, you can avoid expensive mistakes and keep your deliveries on schedule.

Why UAE Import Compliance Matters for Your Shipment

Shipping from Dubai to USA requires proper planning, but sending goods the other way requires even more care. The UAE government strictly watches all products that come into their country. Dubai Customs officers check shipments at every port and airport. If you break a rule, you will face delays that cost you money.

Your shipments often contain valuable items, you must handle them correctly. One small paperwork error can delay your entire shipment for many days. You need to follow the correct process and complete documents properly. This protects your reputation and helps customers receive goods on time.

Essential Documents for Cargo Shipping from Dubai to USA and Beyond

Commercial Invoice Requirements

Your commercial invoice serves as the foundation for customs clearance because it tells the story of your transaction. The document must clearly show exact details of the items you are selling. You need to list product names, quantities, unit prices, and the total value. A company manager must sign the paper and add the official company stamp.

Customs officers look at this document to check the value. They want to make sure the value you wrote matches the real value of the goods. If there is a difference between your invoice and your other papers, they will inspect your boxes. You must make sure the product names on your invoice are exactly the same as the names on your packing list.

Bill of Lading and Airway Bill

The Bill of Lading is the primary transport document for ocean freight. This document proves the cargo has been loaded and specifies the destination and consignee. Your freight forwarder will issue this document when your cargo reaches the port.

If you are using air freight, you use an Airway Bill instead. Both papers are non-negotiable, you cannot clear customs without them. They contain essential information including the shipper’s details, receiver’s details, cargo description, weight, and shipping terms. Keep these papers safe because they represent proof of shipment ownership.

Certificate of Origin Documentation

The Certificate of Origin proves where your goods were made. The UAE uses this paper to decide how much tax you must pay, it also helps to check if any trade agreements apply to your goods. Get this certificate from your Chamber of Commerce before shipping. The certificate must be approved by the Chamber of Commerce in the country of origin.

Some products from specific countries can enter with lower taxes. But you need this certificate to prove it. If you do not have a valid Certificate of Origin, Dubai Customs will charge you the standard tax rate. This will make your total cost higher.

Packing List Specifications

The packing list describes everything in your shipment. The list breaks your shipment down into individual items for easy identification. You must include the number of boxes, each box size, and total weight. Customs officers use this document to check the physical goods quickly.

You must include the Harmonized System (HS) code for each product on this list. This is a special number that tells the government what the product is. If you use the wrong code, it can delay your clearance and also cause you to pay incorrect duty charges. The UAE provides a Smart HS Classification Tool on the TAMM portal to help you identify the correct codes for your goods.

Import Declaration and Trade License

The import declaration is a form you must fill out online. You submit this through the customs website. This digital form includes your HS codes, the value of the shipment, and the receiver’s information. Every shipment needs this form before customs will look at it.

The person or company receiving the goods in the UAE must have a valid Trade License. This license comes from the Department of Economic Development. It gives them permission to bring goods into the country. If the receiver does not have an active license, customs will not process your shipment.

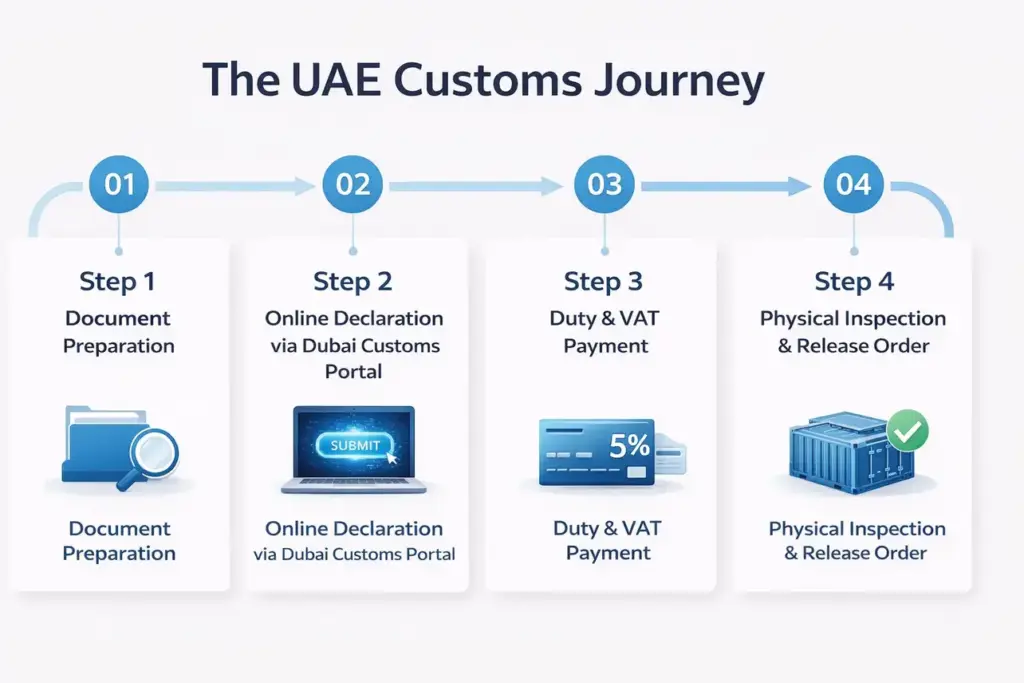

Step-by-Step Customs Clearance Process

Step 1: Prepare and Organize Documentation

Before your shipment leaves the USA, prepare all shipping documents in advance. Confirm the commercial invoice, packing list, certificate of origin, and bill of lading are correct. Make sure every document shows the same details and matching information. Any mismatch can create delays and problems during customs clearance.

Ensure product descriptions are identical on every document. Check the quantities, weights, and values. Ask your shipping agent to look at the documents before the ship leaves. This helps you catch mistakes early.

Step 2: Submit Your Online Declaration

Once your goods arrive in Dubai, your agent will fill out the online form. They use the official customs portal. They will enter all the details about the shipment and the value. The computer system will calculate how much tax you need to pay.

You must do this before the officers inspect your goods. For normal shipments, this process takes about 24 hours. If your goods are complex or restricted, it might take longer.

Step 3: Calculate and Pay Duties and Taxes

In most cases, customs duty is charged at 5% of the CIF value (cost, insurance, freight). Certain categories (for example alcohol and cigarettes) carry much higher rates. Import VAT is charged at the UAE standard rate of 5% at the point of import, although VAT-registered businesses have special reporting rules. You can pay this money online through the customs website or by bank transfer.

Some products might have a lower tax rate if there is a trade agreement. Goods going to a Free Zone might not have to pay duty. Check if your shipment qualifies for any discounts before you pay.

Step 4: Physical Inspection and Clearance

Dubai Customs may choose your shipment for a physical inspection. Officers will check the products, count all items, and review their condition. This check confirms your cargo matches the documents you submitted. This inspection process keeps the country safe and ensures everyone follows the regulations.

If your goods pass the inspection and you have paid the taxes, customs will give you a release order. This means your goods are free to go. You can then deliver them to the warehouse or store.

Prohibited and Restricted Items When Shipping from USA to Dubai

Completely Prohibited Items

The UAE has a strict list of items that you cannot bring into the country. These rules exist to protect the public and follow government laws. If you try to bring these items, officers will take them and destroy them. You will have to pay for the destruction. You might also get into legal trouble.

Strictly Prohibited Items Include:

- All illegal drugs and narcotics (like cocaine, heroin, cannabis, and poppy seeds)

- Fake money or counterfeit currency

- Books or pictures that go against public morals or Islamic beliefs

- Fishing nets made of nylon with three layers

- Machines and tools used for gambling

- Items made in countries that are under a boycott

- Chemicals that damage the ozone layer

- Materials that have radiation

- Asbestos pipes and sheets

- Laser pens that shine red light

- Dangerous waste materials

- Chewing tobacco known as Naswar

- Betel leaves

- Used tires or tires that have been fixed

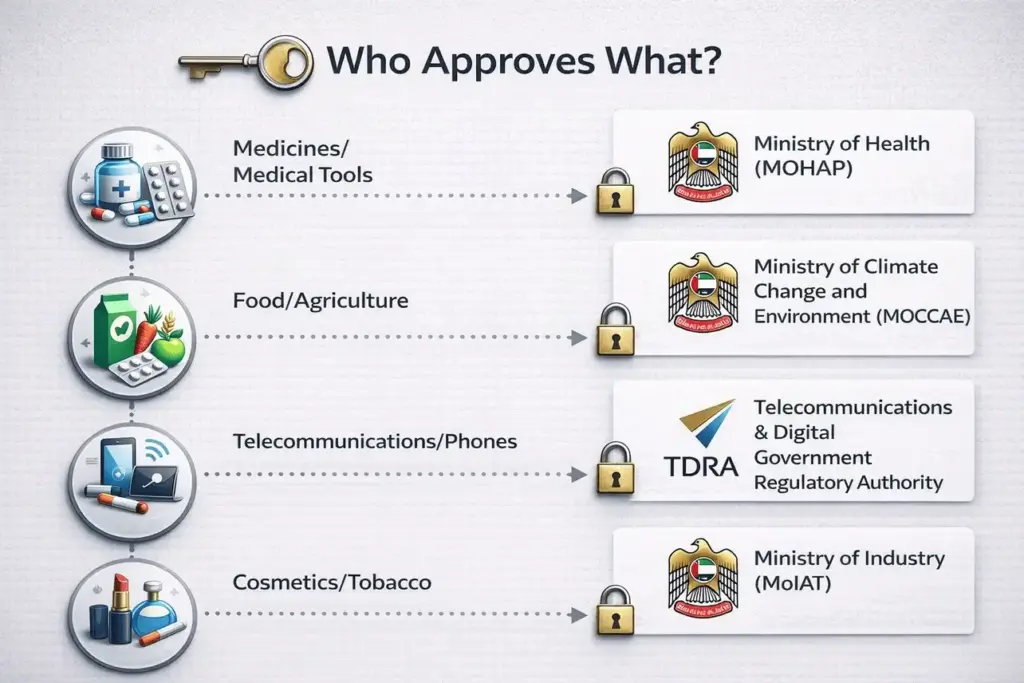

Restricted Items Requiring Permits

There are many items you can bring, but you need special permission first. These are called restricted items. The government watches these items for health and safety reasons. Your agent must get a permit from the right government office before the shipment arrives.

Restricted Product Categories and Who Approves Them:

- Animals and animal products: You need approval from the Ministry of Climate Change and Environment.

- Seeds, fertilizers, and farm products: Approval comes from the Ministry of Climate Change and Environment.

- Food and drinks: The Food Safety Authority must approve these. You also need a health certificate. For meat, you need a Halal certificate.

- Medicines and drugs: The Ministry of Health and Prevention must say yes.

- Medical tools: Approval comes from the Ministry of Health and Prevention.

- Makeup and skincare: The Ministry of Industry and Advanced Technology handles this.

- Cigarettes and tobacco: You need permission from the Ministry of Industry and Advanced Technology.

- Phones and GPS devices: The Telecommunications Authority must approve these.

- Cars and new tires: The Ministry of Industry and Advanced Technology checks these.

- Chemicals: You need a permit from the Executive Office for Control.

- Books and magazines: The Media Council must review these.

Different offices handle different items. For example, cargo shipping from usa to dubai that includes medicine goes through the Ministry of Health. But if you are moving food, you talk to the Food Authority. Contact the relevant authority to understand specific requirements for your goods.

Best Practices for Smooth Customs Clearance

Work with Qualified Customs Brokers

A professional broker knows the rules well. They can guide you through every step of cargo shipping from Dubai to USA or from the USA to Dubai. They know exactly which papers you need. They also know how to fill out the forms without mistakes.

An expert broker knows what problems might happen. They have good relationships with the customs officers. They understand how long things take. Using a professional lowers the chance of errors that cost money.

Double-Check All Documentation

Even a tiny mistake can stop your shipment. You must check that every detail is the same on every paper. The product codes must match. The numbers must be equal. The values must be the same. A simple spelling mistake can stop your goods for a long time.

Stay Current with Regulations

UAE changes its customs rules often when the government updates taxes and laws. You should sign up for customs updates or ask your shipping agent for new information. Knowing the current rules helps your goods follow all the latest requirements successfully.

Use the Smart HS Classification Tool

The UAE provides the Smart HS Classification Tool on the TAMM portal to help identify correct Harmonized System codes for your goods. This specialized search engine shows the correct HS code and indicates any associated approvals or regulatory requirements. You can contact the Tariff Classification Department at follow-up@adcustoms.gov.ae if you need additional assistance.

Attestation of Documents

Your invoice and shipping papers need a signature from the Ministry of Foreign Affairs. This signature proves your documents are real and stops delays at the customs office.

Conclusion

Understanding the rules makes shipping to dubai from usa much easier. If you follow this checklist, prepare your papers correctly, and work with experts, your goods will arrive on time. Proper planning stops delays and saves you money. The process is simple when you know the steps.

Ready to simplify your global logistics? Partner with SeaTrans Agencies for seamless shipping from the USA to Dubai. Trust our experts to handle customs and delivery, moving your business forward today.