Clearing cargo at a Philippines sea port requires following many rules and dealing with different government departments. Without expert help, you face shipping delays, fines, and expensive mistakes. Every Philippines sea port handles thousands of containers every day. Each container needs correct paperwork and quick processing.

Professional help ensures your cargo moves through customs without problems. This saves you from paying extra storage charges. First-time importers and experienced shippers both benefit from working with qualified professionals who understand the clearance process.

Understanding the Philippines Sea Port Clearance Process

The sea port Philippines operates under a system controlled by the Bureau of Customs and port authorities. Your cargo arrives at major ports including Manila International Container Terminal, Port of Cebu, or Port of Subic. Manila handles approximately 5.5 million TEUs annually, making it the busiest Philippines sea port name. The customs clearance process begins immediately after your ship docks at the port.

The system uses three different lanes to process cargo based on assessed risk level. Each lane has specific inspection rules, documentation requirements, and processing times for cargo release. The computer assigns your cargo to one lane automatically based on submitted documents and cargo type. Understanding these lanes helps you prepare better paperwork and avoid processing delays.

Customs officers compare your documents with actual goods inside your shipping containers carefully and thoroughly. When they find differences, they immediately order additional inspections that delay your shipment significantly. A professional customs broker knows exactly what information officials need for smooth clearance. They prepare all documents in the precise format that customs requires for approval.

The Three Customs Clearance Lanes Explained

Every shipment passes through one of three clearance channels based on document completeness and cargo type.

Green Lane: Fast Track Clearance

Green lane provides the fastest clearance option for low-risk shipments with complete accurate paperwork. Shipments get approved within twenty-four to forty-eight hours without delays or physical inspections. Your goods move straight from ship to storage yard and then to your warehouse. This lane saves significant money on storage fees because cargo leaves port quickly.

Yellow Lane: Document Inspection

Yellow lane means customs officers will check all your documents before releasing your cargo shipment. This review process typically takes three to four full working days to complete successfully. Officers verify that product descriptions match exactly what you shipped in the containers accurately. If officers find mistakes, you must fix them before cargo release happens properly.

Red Lane: Physical and Document Inspection

Red lane is the slowest option and costs importers the most money overall. Customs officers conduct both document review and complete physical inspection of your actual cargo. They open containers, count every item, and verify that the condition matches your declarations completely. This process takes seven days or longer depending on cargo complexity and volume. Research shows that documentation errors cause delays averaging five to seven days.

Critical Documentation Requirements

Submitting correct complete documents prevents most clearance delays importers experience at ports. Missing paperwork remains the main reason cargo gets stuck at customs.

Essential Documents for Cargo Clearance

The Bill of Lading proves you own the shipment and shows your contract agreement. Your Commercial Invoice must display the exact declared value matching your customs entry form. The Packing List describes each item with weight, dimensions, and quantity details. The Import Entry Declaration starts the formal clearance process through the Bureau of Customs website.

Proof of Payment shows you paid all required duties and taxes before cargo release. Import Permits are mandatory for regulated items including food, electronics, and chemical products. The Certificate of Origin may reduce tax rates when trade agreements apply. You must submit all papers before your ship arrives at the port.

The Role of Harmonized System Codes

HS codes determine exactly how much import tax you pay on your goods. Using wrong classification codes costs extra money and creates serious legal compliance problems. This six-digit number tells customs officials exactly what product type you are importing. Even one wrong digit can double your tax bill or trigger red lane inspections.

Common HS Code Mistakes

Many importers select wrong HS codes because the international classification system is very complicated. Research shows that approximately forty percent of customs penalties result from incorrect HS code classifications. Electronic items are classified by function and purpose, not just by manufacturing materials used.

When customs finds wrong codes, they move your shipment to red lane immediately. This error adds five to seven extra days to your total clearance processing time. Professional customs brokers verify every HS code against latest official tariff schedule books. They understand how to correctly classify complex mixed products containing multiple different materials.

Port Operations and Cargo Handling

Manila International Container Terminal processes more than two million TEUs every year successfully. The terminal runs operations twenty-four hours daily using modern cranes and automated systems. Other major facilities include Port of Cebu handling 820,000 TEUs and Port of Subic processing 600,000 TEUs annually.

Container Handling Process

Ships unload containers at specific dock areas designated for different vessel types and sizes. Port workers move containers to storage yards using specialized trucks and overhead crane equipment. Your cargo waits until customs officials release it for final pickup and delivery. The complete process normally takes two to five days under standard conditions.

Port handling fees add significant costs to your total import expenses you must budget. A twenty-foot container costs approximately five thousand two hundred pesos in arrastre charges. A forty-foot container costs around twelve thousand six hundred pesos at Manila port facilities. You pay these charges for every day your cargo remains at port waiting. A seven-day red lane delay costs over thirty-six thousand pesos in storage alone.

Why Professional Customs Brokers Are Essential

Hiring a professional customs broker transforms difficult clearance processes into simple smooth operations successfully. These experts know all rules and maintain good relationships with customs officers.

Key Benefits of Professional Representation

A qualified broker ensures your documentation meets all official requirements set by government agencies. They maintain updated knowledge of current tariff rates for every product category available. They communicate directly with Bureau of Customs on your behalf, removing confusion completely.

Professional brokers work daily with shipping lines, terminal operators, and government offices across departments. These relationships help solve problems much faster when issues arise during clearance processes. Modern brokers use tracking software showing your exact cargo location in real time. Professional brokers handle difficult shipments with special requirements like temperature control or hazardous materials.

Common Mistakes in Cargo Clearance

Documentation Errors

Wrong or incomplete documents cause more delays than any other problem importers face. Common errors include mismatched invoice values and wrong quantities on packing lists significantly. These problems cost importers thousands of pesos in accumulated storage fees and penalties.

Undervaluation of Goods

Some importers deliberately declare lower values to pay less import tax to customs officials. This practice is illegal and customs catches it easily through automated value checking systems. Getting caught means you pay penalties worth twice the unpaid taxes immediately today.

Missing Import Permits

Food products, medicines, and electrical equipment need advance permits from specific government agencies. Arriving without required permits causes immediate holds on your entire shipment for weeks. This mistake costs more than the value of your imported goods sometimes permanently.

Poor Communication

Not submitting documents on time creates completely unnecessary delays for all importers shipping goods. Missing official deadlines extends red lane inspections and adds more storage days automatically. Professional brokers maintain constant communication with all parties throughout the entire process.

How Professional Services Save Money

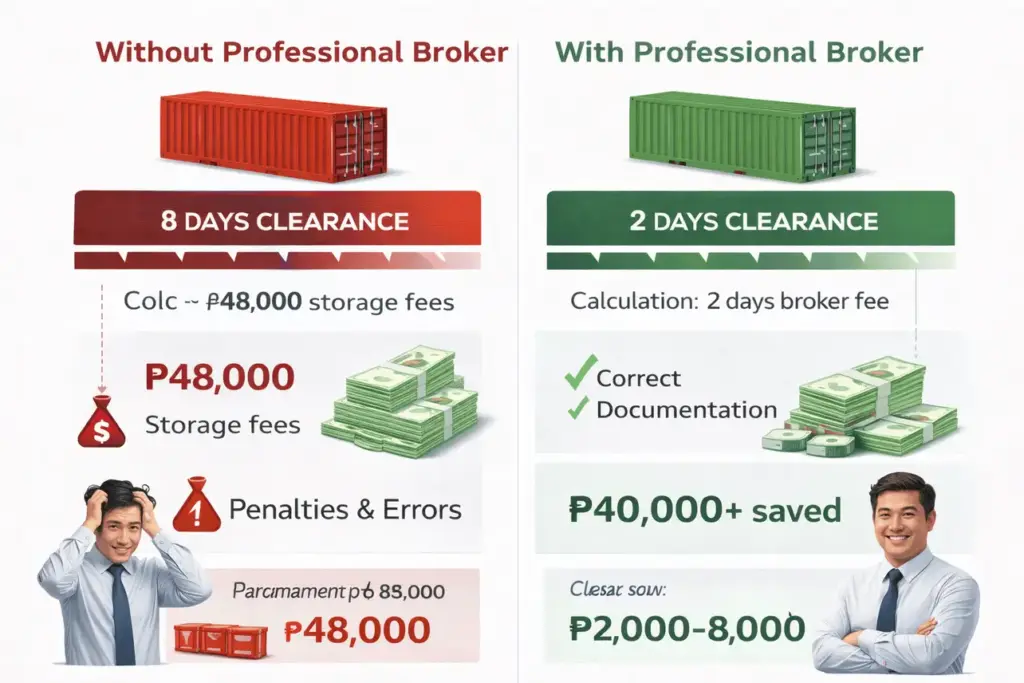

Affordable Investment: Hiring professional customs clearance services costs between 2,000 to 8,000 pesos per shipment. This fee saves much more money through avoided penalties, fines, and storage charges.

Real Cost Example: Here is how document errors cost you thousands in unnecessary expenses:

- Your 40-foot container has document errors and gets red lane assignment

- Normal clearance takes 2 days but red lane takes 8 full days

- You pay 6 extra days totaling about 48,000 pesos just for storage

- A professional broker would have spotted and fixed errors before submission

- This saves 48,000 pesos plus lost sales from delayed deliveries

Tax Optimization: Brokers find legal ways to reduce import tax bills every shipment. They use correct HS codes with lower tax rates under current regulations.

Yearly Savings: For regular importers shipping monthly, these combined savings reach tens of thousands of pesos every year.

Ensuring Compliance and Avoiding Penalties

Breaking customs regulations has serious consequences beyond just paying financial fines and penalties. Repeated violations make customs watch all future shipments very closely with extra scrutiny. Some violations can ban you from importing temporarily or permanently from Philippines ports.

Professional brokers keep detailed records of all shipments stored securely for years. They track when rules change and immediately update procedures to match requirements. Good record keeping proves you followed all rules correctly during compliance audits.

Conclusion

Successfully clearing cargo at a philippines sea port requires more than just basic shipping knowledge. The system combines customs regulations, port procedures, and strict documentation rules that change regularly. Many things can go wrong at each step without proper guidance and professional expertise. Professional expertise in cargo clearance protects your business from delays, penalties, and compliance violations effectively.

Companies that use professional clearance services experience faster processing times and pay lower overall costs. They have fewer business disruptions and their supply chains run smoothly without unexpected delays. Choose Sea Trans Agencies for expert cargo clearance that eliminates delays and saves thousands in fees. Our licensed brokers deliver fast, reliable results you can trust completely.