Global trade has changed significantly in recent years, making it harder to predict customer demand accurately. Shipping routes get blocked more often and reliable delivery has become a major concern for supply chain teams. These problems affect how carriers and shippers plan space, set prices, and move goods across international borders.

For businesses today, bad capacity planning means paying more for shipping, running out of stock, and losing customer trust. This article explains the main capacity problems and what you can do to improve your shipping operations.

Understanding the Difference Between Shipper and Carrier in Daily Operations

Before you fix capacity planning, you need to understand who does what in the shipping process clearly. The difference between shipper and carrier forms the base of every shipping contract and booking decision made today.

When people get these roles wrong, it leads to confusion, bad communication, and wasted money for everyone. Simply put, the shipper is the business or person who owns the goods being transported to customers. The carrier owns the ship, plane, or truck and moves the goods from one location to another.

The difference between shipper and carrier starts with who owns the products and who provides the transportation equipment. This basic split determines who handles paperwork, sets booking times, and makes service promises to customers.

Core Responsibilities That Define Each Role

The shipper focuses on keeping the supply chain moving, managing orders, watching inventory levels, and serving end customers well. The carrier focuses on using their ships and trucks efficiently, filling up available space, staying on schedule, and making profit. A clear difference between shipper and carrier helps each side track the right performance indicators like on-time delivery.

Shipper vs Carrier Responsibilities in Capacity Planning

An easy way to see shipper vs carrier roles is through three stages of planning, execution, and review. In planning, the shipper shares volume predictions, busy season information, and preferred shipping routes with carrier partners. The carrier looks at this data and decides how much ship space to allocate and when to schedule sailings.

Good data from the shipper helps the carrier use their transportation assets much more effectively for everyone. When executing the plan, the shipper must book shipments on time and send the promised cargo volumes.

The carrier must protect reserved space, manage booking delays properly, and communicate schedule changes to shippers very quickly. When reviewing performance, shipper vs carrier meetings check how accurate predictions were and verify if contracts were followed properly.

Key Capacity Challenges Across Global Trade Lanes

Space availability in global trade never stays the same for very long periods of planning time. Room on ships, availability of containers, and inland transport space change because of many different shifting factors today.

These include sudden demand increases, port delays, worker strikes, regulatory changes, and equipment shortages affecting daily operations. Each challenge hurts supply chains by raising transportation costs and making deliveries take much longer than expected.

Demand Volatility and Forecast Accuracy

One major problem is demand that changes suddenly without much warning for planning teams to prepare properly. Quick increases from big sales events or large project cargo can use up all previously booked space.

If volume predictions are wrong, carriers cannot position enough containers or change sailing schedules fast enough to meet needs. Shippers then have to use the expensive spot market, pay much higher rates, or accept longer delivery times.

Trade Lane Imbalances and Equipment Shortages

Another serious issue is the uneven cargo flow on major trade routes connecting different regions globally today. Some routes send out much more cargo than they bring in, creating major operational imbalances for carriers worldwide.

Empty containers pile up in one country while running critically short in another region that needs them. This imbalance affects container availability, impacts truck chassis supply, and makes it more expensive to reposition empty equipment.

Port Congestion and Infrastructure Limits

Port delays and outdated terminal facilities add significant pressure to capacity planning for both parties involved daily. When ports experience long vessel waiting times or slow cargo handling operations, carriers have to change published schedules.

This disrupts careful planning for both sides and causes missed bookings, rolled cargo, and very uncertain arrival dates. For businesses shipping urgent goods or operating just-in-time delivery systems, these delays create serious operational and financial problems.

Regulatory and Geopolitical Disruptions

Government rules and political changes also affect available capacity in ways that are hard to predict accurately. Trade sanctions, new customs requirements, and sudden policy changes can redirect entire cargo flows almost overnight without warning. Business leaders need flexible backup plans to handle these sudden events without losing their hard-earned service quality.

How Capacity Challenges Shape Value for Carriers and Shippers

Capacity problems affect much more than just the base shipping costs that appear on invoices today. They directly change working capital requirements, sales reliability, customer satisfaction, and critical supplier relationships for growing businesses worldwide. For carriers and shippers, the strong link between capacity management and overall business success is both direct and measurable.

Impact on Shipper Operations and Costs

For shippers, poor access to guaranteed shipping space often forces them to keep much larger safety stock levels. This extra inventory ties up valuable working capital and adds significant warehouse storage costs to monthly operating expenses.

Late shipments cause factory production delays, missed customer delivery deadlines, and expensive penalty charges from retail partners worldwide. Common operational problems for shippers include more money stuck in extra safety inventory across multiple warehouse locations.

They also face higher total shipping costs from last-minute emergency spot market bookings at premium rates today. Lost sales occur because products run out of stock at critical selling moments during peak seasons.

Impact on Carrier Network and Profitability

For carriers, poor capacity planning means some routes run half-empty while other popular routes are overbooked completely. Moving empty containers back to high-demand origins costs significant money and seriously lowers overall profit margins substantially.

Repeated service problems and schedule delays hurt their market reputation and weaken long-term contracts with important customers. Steady and predictable cargo volume from reliable shippers is absolutely essential for maintaining any carrier’s network health.

Practical Strategies to Align Supply and Demand for Space

Good capacity strategies must focus on accurate data sharing, smart contract design, and very careful day-to-day operations. A well-structured approach consistently delivers better service performance and much more stable shipping costs over time.

Shipper Side Best Practices

Shippers can start improving results by developing much more accurate demand forecasting across all their product lines. Sales teams, purchasing departments, and logistics managers should work together and agree on detailed shipment plans organized by route.

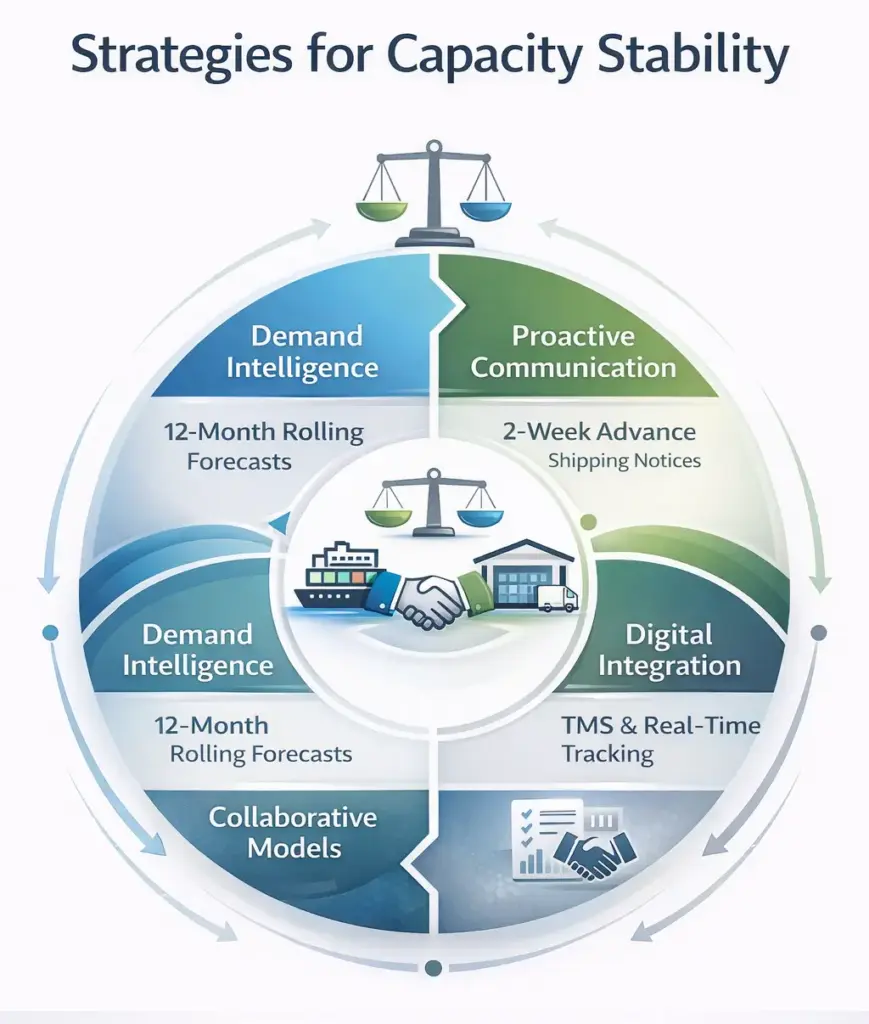

Key practical actions shippers can take include creating rolling twelve-month volume forecasts that get updated monthly. They should share advance shipping notices with carrier partners at least two full weeks before expected dates. Making firm commitments to yearly volume ranges with structured quarterly performance reviews builds much stronger partnerships over time.

Carrier Side Best Practices

Carriers can support better planning by offering very clear and transparent service package options to their customers. Clear written explanations of service levels, free time allowances, and all extra charges help reduce billing disputes. Reserved space blocks for strategic high-volume customers can generate steady revenue streams and improve network utilization rates.

Regular structured performance reviews make these capacity strategies actually work in daily operations and drive continuous improvement. Monthly or quarterly business review meetings to examine actual volume and on-time delivery performance help everyone improve.

Digital Tools That Support Capacity Planning

Modern digital tools now play an absolutely essential role in professional capacity planning for global trade operations. Transport management systems give shippers clear real-time visibility of all bookings, accurate transit times, and total costs. Advanced tracking platforms show exactly where ships are located right now and predicted arrival times accurately.

Electronic connections between shipper systems and carrier booking platforms dramatically cut down on time-consuming manual data entry. This shared real-time data helps both sides improve their volume forecasts significantly and take early action.

Collaboration Models That Reduce Capacity Risk for Businesses

The most effective long-term answers to capacity challenges come from building strong partnerships that last for years. Companies consistently get much more total value from structured and transparent ways of working together over time.

Joint Business Planning Between Partners

Working together on detailed business planning is extremely important for managing capacity effectively in uncertain market conditions. Shippers and carriers can develop shared yearly operating plans that connect realistic sales targets and clear service goals. These collaborative plans help match capacity investments and detailed schedule design with real underlying business needs.

The Value of Working With Logistics Specialists

For many growing businesses, working with an experienced and well-connected logistics partner adds significant operational strength and market access. Professional freight forwarding companies can dramatically improve communication quality and secure priority access to capacity during tight periods. Partners with strong established carrier networks and deep local port knowledge give supply chain leaders many flexible options.

Conclusion: Building Stronger Capacity Partnerships in Global Trade

Managing capacity will remain an extremely important topic for all global trade leaders in coming years ahead. Ongoing demand spikes, unexpected route changes, and persistent port delays will continue testing even the strongest supply chains. When you clearly understand roles, build clean data sharing flows, and create fair balanced contracts, you turn capacity planning into something that brings real stability and growth.

Sea Trans Agencies bring many decades of proven shipping knowledge, strong established carrier relationships, and tested capacity management methods to help businesses secure space reliably. Contact our experienced team today to build a professional capacity strategy that protects your critical global trade operations.