Shipping goods internationally can often be quite unpredictable and stressful for new business owners. Sometimes important documents get lost or ships arrive much earlier than you expected. A letter of indemnity effectively helps you manage these common logistical problems.

It is a safety agreement that protects businesses from financial loss during global trade. This document is very important for new shippers in today’s fast-moving market. It ensures your cargo keeps moving even when standard paperwork is missing or delayed. This guide explains everything you need to know about this essential shipping document.

What Is a Letter of Indemnity in International Shipping?

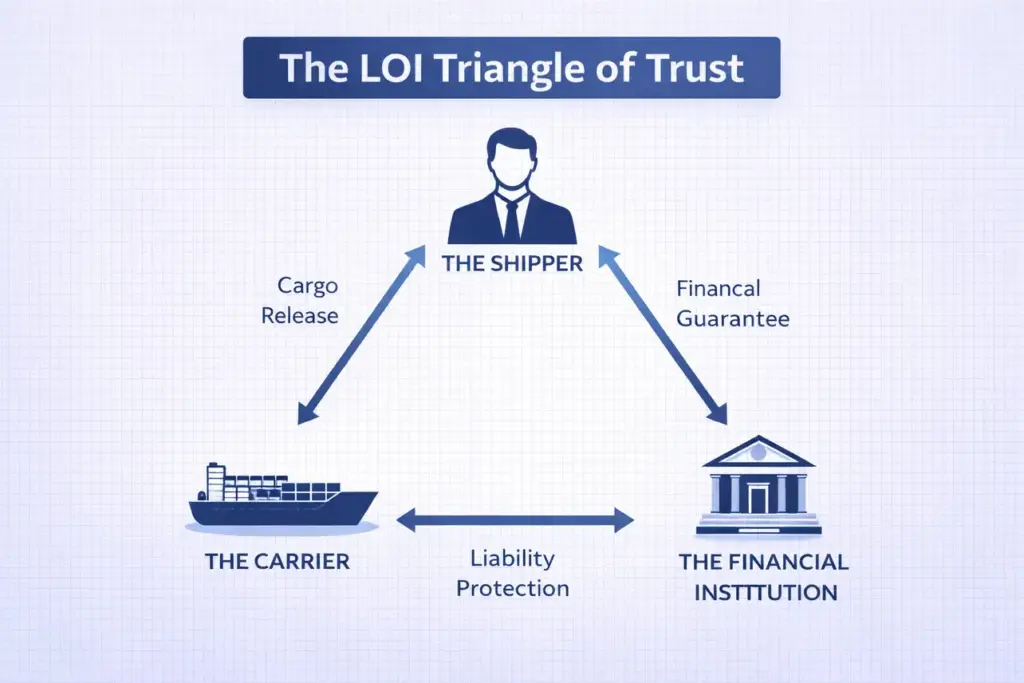

A letter of indemnity is a binding legal contract used in shipping. In this contract, one party promises to pay another party for future losses. In the shipping industry, it works like a protective shield for your business. It protects companies when valuable goods cross international borders without proper documentation. The document creates a serious promise between the shipper, the carrier, and the bank.

The Primary Purpose in Maritime Logistics

The main job of a letter of indemnity is to protect the carrier. It allows them to release cargo even if standard rules cannot be followed. This usually happens when the original bill of lading is lost or delayed. Without this letter, the carrier would hold the goods at the port indefinitely. This causes significant delays and additional costs for everyone involved in the process. The letter allows the carrier to hand over the goods right away.

Key Stakeholders Involved in the Agreement

Three main parties must sign this important legal agreement for it to work. First is the carrier, who needs protection against potential future legal claims. Second is the shipper or receiver, who wants the cargo released immediately. Third is a bank or insurance company that acts as a financial guarantor. Their signature proves that there is money available to cover any problems.

Understanding the Concept of Letter of Indemnity and its Implications

The word “indemnity” simply means protection against financial loss or legal damage. In shipping, it acts as a financial safety net for your business. If something goes wrong, the indemnity letter says who must pay for damage. The letter of indemnity meaning is really about accepting financial responsibility. It creates a clear rule about who pays if a problem happens later.

Facilitating Global Trade Efficiency

This document helps global trade move smoother and faster in three specific ways. First, it helps cargo move fast, even if paperwork is moving slowly. Second, it makes it clear who is responsible for specific mistakes or errors. Third, it gives carriers confidence to deliver goods without the original bill. They know they will not lose money if they deliver goods early.

Why Global Shippers Need a Letter of Indemnity

Resolving Critical Timing Discrepancies

Modern container ships travel very fast across the ocean to their destinations. Often, a ship arrives at the port before the paperwork arrives by mail. This creates a major problem for the owner who needs their goods. The owner wants their goods, but the captain cannot give them up.

Mitigating Financial Risks and Delays

A letter of indemnity fixes this common timing problem for international shippers. It tells the carrier to release the goods now and promises paperwork later. This saves money by avoiding expensive port storage fees and demurrage charges. If goods sit at the port, the owner must pay these high fees. Using this letter helps importers save cash and keep their business running.

Managing Lost or Missing Documentation

Shippers also use a letter of indemnity when accidents happen with documents. Sometimes a bill of lading gets lost, destroyed, or misplaced during transit. Instead of waiting weeks for a new one, the shipper uses this letter. This allows them to get their cargo without a long, expensive wait.

Essential Components of a Valid Letter of Indemnity

The format for letter of indemnity is standard around the world today. Most letters contain the same key parts to ensure they are legally valid. You must include these parts to make the letter work for everyone.

Header Information and Date

Write “Letter of Indemnity” clearly at the top of the page for clarity. You must include the date the document was signed by all parties. You must also state which country’s laws apply to the specific agreement.

Accurate Identification of All Parties

List the names and addresses of everyone involved in the shipping transaction. This includes the shipper, the carrier, the bank, and the receiver. Correct names are very important for legal reasons and avoiding future disputes.

Comprehensive Cargo Specifications

Describe the goods clearly so there is no confusion about the shipment. Write down the product type, the weight, and the number of packages. You must also include the ship’s name and the specific container numbers. These details connect the letter to your specific shipment and avoid confusion.

Explicit Statement of Reason

Explain exactly why you need this letter for this specific shipment today. Usually, you will write that the original bill of lading is missing. You might also use it if you need to change the delivery port.

Terms of Agreement and Obligations

Write down the promises that each party is making in this agreement. The carrier promises to release the goods to the receiver immediately upon arrival. The shipper promises to pay for any financial losses that might occur. The bank promises to guarantee the payment if the shipper cannot pay.

Liability Limits and Compensation Clauses

This section talks about money and who pays for specific damages. It states the maximum amount the shipper will pay for any claims. It explains what kinds of losses are covered by this specific agreement. It also says how to file a claim if there is a dispute.

Authorization and Signatures

Authorized people must sign the letter to make it a legal document. This means a manager or director from the shipping company must sign. Sometimes you need a witness or a notary to sign it too.

Drafting a Letter of Indemnity: A Practical Template

Writing a draft letter of indemnity is easier with a standard template. Here is a simple example of what it looks like for reference.

LETTER OF INDEMNITY

Date: [Insert Date]

To: [Insert Carrier Name]

We ask you to deliver the cargo listed below without original documents. Because you agree to do this, we promise to protect you financially.

Cargo Details:

- Vessel Name: [Name]

- Bill of Lading Number: [Number]

- Port of Loading: [City]

- Port of Discharge: [City]

- Cargo Description: [Details]

Indemnity Clause:

We accept full responsibility for this request and any resulting financial claims. We will pay for any claims because you released this cargo early.

Bank Guarantee:

[Bank Name] agrees to join this agreement and guarantees payment for valid claims.

Governing Law: [Country Law]

Signed by: _________________ (Shipper)

Countersigned by: _________________ (Bank)

The Role of Financial Institutions in Indemnity

Why Banks Are Essential Partners

Banks and insurance companies are very important for these letters to work. A carrier trusts a bank more than an individual shipper or business. When a bank signs the letter, it proves the shipper has money. The letter of indemnity for banks usually lists the bank’s specific limits.

Securing Bank Endorsement Requirements

If you need a bank to sign your letter, you must prepare. You need to show them all the shipping papers for the transaction. You must explain why the original bill of lading is currently missing. The bank will charge a fee for this service and check credit.

Leveraging Insurance for Indemnity Protection

Insurance Company Guarantees

An insurance letter of indemnity is like a bank guarantee from an insurer. Insurance companies understand shipping risks very well and offer these to clients. They often provide these letters for their regular clients to facilitate trade.

Coverage Scope and Exclusions

Insurance letters have specific rules about what they will and will not cover. They say exactly what is covered and list specific exclusions to coverage. For example, they usually will not pay for losses caused by illegal acts.

Strategic Use Cases for Letters of Indemnity

Handling Missing Original Bills of Lading

This is the most common reason to use this document in shipping. The ship arrives, but the papers are legally stuck somewhere else. The shipper gives an indemnity letter to get the goods right away. This stops storage costs from adding up and hurting the business profit.

Modifying the Port of Discharge

Sometimes a business needs to change the destination while the ship moves. If the ship is moving, the paperwork lists the old port name. A letter of indemnity protects the carrier when they deliver to new ports.

Expediting Cargo Release Upon Arrival

Sometimes a factory needs raw materials right away to keep production running. They cannot wait even one day for papers to arrive by mail. They use a letter of indemnity to get cargo when the ship docks.

Letter of Indemnity vs. Bank Guarantee: Key Differences

It is helpful to know the difference between these two important documents.

| Aspect | Letter of Indemnity | Bank Guarantee |

|---|---|---|

| Who Issues It | Any business or person | Only banks |

| Promise Type | Promise to pay back | Direct commitment to pay |

| Purpose | Protects specific actions | Protects against non-payment |

| Cost | Usually low or free | Bank fees apply |

| Payment | Legal action often needed | Bank pays on demand |

Assessing Risks and Legal Limitations

Impact on Existing Insurance Policies

Using a letter of indemnity can sometimes cancel your other insurance policies. Standard shipping insurance often has strict rules about releasing cargo without documents. They might not cover you if you release cargo without the bill. Always check with your insurer first before signing any indemnity agreements.

Risks of Cargo Misdelivery

There is a risk of giving cargo to the wrong person accidentally. If a carrier releases goods based on your letter, problems can arise. You will have to pay for the value of the goods.

Navigating Legal Uncertainties

Laws are different in every country and can cause legal confusion. In some places, courts do not like letters of indemnity at all. They might not enforce them if a dispute happens in court. This creates legal risk if a dispute happens in a foreign port.

Conclusion

The letter of indemnity is a vital tool for global shippers today. It helps you handle the complex world of international trade with confidence. This document keeps your goods moving efficiently, even when paperwork is delayed. It is important to understand the letter of indemnity clearly.

This knowledge helps you manage risk and avoid expensive shipping delays. Whether dealing with missing bills or changing ports, this letter protects everyone. By following this guide, you can use this document with confidence.

Don’t let complex paperwork slow down your global business operations this year. Partner with Sea Trans Agencies today for reliable, expert shipping solutions you can trust.